The term “proactive” can be found on the websites of countless accountancy firms throughout the United Kingdom and further afield. It has become the standard marketing message that attempts to reassure existing and prospective clients that, “by choosing us, you are in safe hands and we won’t miss an opportunity to help you and your business”. But how much thought has been put into the meaning of the word itself?

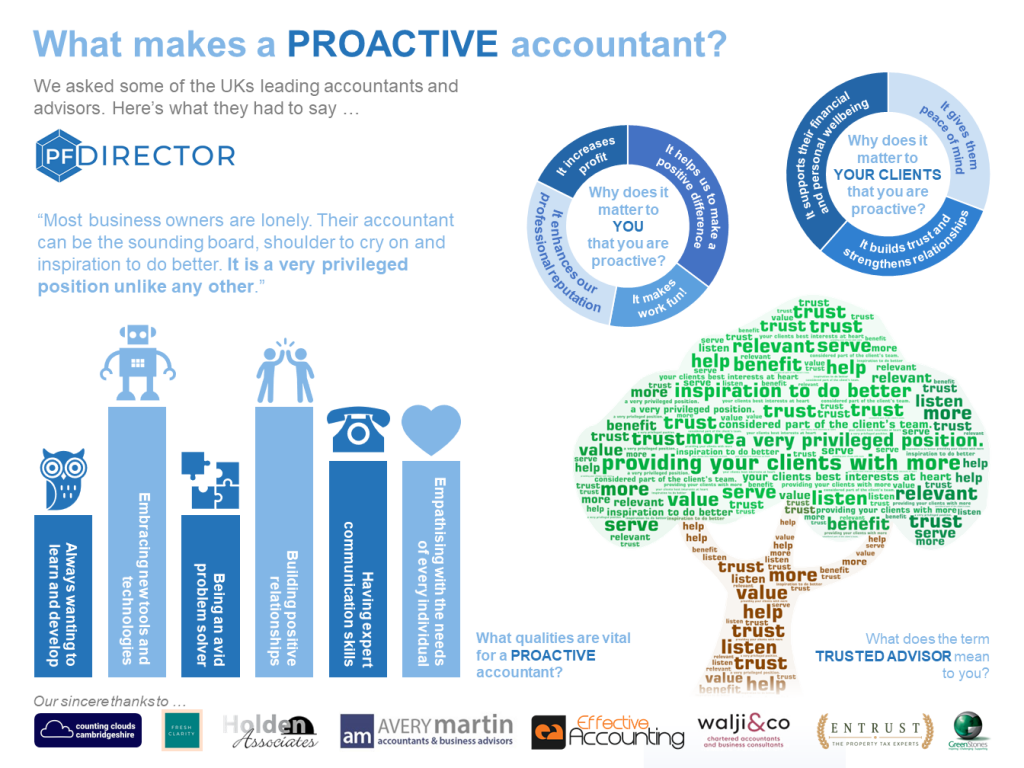

Here at PF Director, we have spent a few months looking at the question “what makes a proactive accountant?”. We discussed the issue with some of the UK’s leading accountants in practice in order to break the term “proactive” down into its constituent parts, with the hope of piecing together a framework that can help accountants become more, well… proactive.

What does the term proactive really mean?

The Cambridge English Dictionary describes the adjective proactive as ‘taking action by causing change and not only reacting to change when it happens’. For me, the term action is the most significant in the description, but action on its own is not enough. The action must be unsolicited, relevant, timely and must have the expectation of a positive outcome. In my opinion, all four of these elements must be present for the situation to be described as proactive.

The question is, how do accountants ensure that the service they provide encompasses all four elements which makes the term proactive a legitimate description of their offering to clients?

Proactive – ‘taking action by causing change and not only reacting to change when it happens’

Cambridge English Dictionary

Let’s delve deeper.

We asked some of the leading UK accountants in practice the following question:

What qualities are vital for a proactive accountant?

There were 6 strong themes that came out of all of the discussions that we had. We will now look at each vital quality of proactive accountants in turn.

1. Always wanting to learn and develop

Of course, it makes complete sense that for us to have the expectation for the advice that we give as accountants to have a positive outcome, we must strive to continuously improve our knowledge and understanding in the areas in which we are helping clients. This does not mean that we must be the master of everything. However, in the areas that we choose to support the clients, we need to make sure that we are on top of our game. This will empower us to talk to clients with confidence and with authority.

Equally as important is our ability to recognise our limitations. There can sometimes be an over-riding urge to display that we can provide the answer to all our clients’ queries on the spot. If we are not able to give the client an answer, then we have failed, right? Wrong! A great advisor will know the extent of their knowledge and will concede to the client when they do not have an immediate solution to their problem. They will refer the client to a third party who is expert in that particular field, or perhaps they will go back and do the necessary research themselves to further their own knowledge. No immediate advice is far better than bad advice.

‘A proactive accountant should be someone who enjoys learning and who is keen to always develop their knowledge throughout their career. They should have an inquisitive mind’.

Caroline Harridence of Counting Clouds

Proactive accountants ‘constantly look to improve their knowledge and experience, through CPD and networking’.

Nicola Sorrell of Effective Accounting

2. Embracing new tools and technologies

Anyone who remembers the introduction of spreadsheet software and its ability to take the place of the paper cashbook will be in no doubt of the benefit which advances in technology can bring to the accountant and their clients.

Tools and software which leverage the accountant’s time really increase the accountant’s ability to provide a proactive service to clients. Of course, the accountant’s ability to deliver timely advice alone is not enough. The system must take in relevant data and convert it into meaningful information that is relevant to the client and their business.

The accountancy industry, like all others, has had a constant flow of new technological solutions entering the market in recent years. Beware software providers that encourage the use of their software just because their technology is new and exciting. Ask yourself, “what problem does this software or tool solve for me and/or my clients?”.

Accountants should ‘seek to find the best software and technology to better manage the client’s finances in order to offer a real-time approach to the numbers’.

Nicola Sorrell of Effective Accounting

We have ‘systems and processes in place’ in order to be able to find the time to provide a proactive service.

Shaz Nawaz of Entrust Property Tax Experts

‘We use the latest accounting technology in order to ensure that we provide clients with up to date, timely and accurate information. We can advise on how to streamline and automate the clients’ processes and look to help them become more efficient and to also save time by reducing manual processing tasks.’

Caroline Harridence of Counting Clouds

3. Being an avid problem solver

Having the drive and determination to identify opportunities and solve problems that clients are facing, even before they realise that they have a problem (or opportunity) themselves, is a key quality that a truly proactive accountant must have. In a way, the extent of an accountant’s ability to problem solve a client’s situation in advance is what underpins the level of their proactive status.

Unsolicited, relevant and timely.

‘You need to be able to anticipate customer problems to start with. What are they going to be calling up about and then call them before they call you. What is going on in their world that you can help them with?’.

Simon Chaplin of GreenStones

It is vital that accountants are ‘leading the client advisory relationship and therefore not being reactive to client demands’.

Jason Holden of Holden Associates

4. Building positive relationships

In days gone by, the accountant/client relationship was often perceived as being based upon the notion of “us and them”. As within many professions, accountants demanded unconditional respect for their level of education and societal status. When advice was “given” by the accountant, it was often a one-way relationship – almost akin to that of a teacher/student. However, in more recent times, these thoughts of grandeur have rapidly evaporated, for the better.

Accountants have realised that the way to truly get to the heart of the matter of financial issues faced by their clients is, quite simply, to get to know them better.

It seems common sense that to identify the underlying issues and opportunities facing a client, the accountant must first build up a deep relationship – built on two-way trust and respect.

The stronger the relationship, the better the knowledge of the client’s circumstance, the more relevant the advice and the greater the expectation of a positive outcome for the client.

Accountants ‘should have an inquisitive mind and really want to get to know their clients and understand their requirements’.

Caroline Harridence of Counting Clouds

5. Having expert communication skills

To ensure that any advice that we give to clients is relevant and timely, it is vital that, as accountants, we have great communication skills.

It is not enough to send asynchronous communications to clients (e.g. via email, or letter) in the hope that they will read and fully digest what we are saying. We must engage fully in two-way conversation, through whichever media is most appropriate, to ensure that we, both, understand and are understood.

Effective communication cannot be left to chance. Our communication channels between ourselves and clients must be well thought out and appropriate for the matter in hand. It must promote discussion, rather than oppress it.

‘Keeping ahead of the game, keeping clients informed to let them punch above their weight‘.

Glenn Martin of Avery Martin Accountants

Proactive accountants must have ‘a communication strategy to keep in touch with clients. They need to be having regular meetings with clients’.

Shaz Nawaz of Entrust Property Tax Experts

6. Empathising with the needs of every individual

As accountants, we make assumptions every day. We assume that all clients want to earn higher profits than at present, want to pay less tax, and sometimes even that clients want to spend as little time talking to their accountant (i.e. you) as possible.

We need to move away, far away, from this perceived understanding that we have of our clients.

Each client is different. We need to ensure that we are asking the right questions of clients in order to get to their root beliefs, wants and goals.

For example, it is often the case that clients are overworked and stressed. We may or may not pick up on this in our dealings with the client – depending on the quantity and quality of discussions we are having with them. However, this unwanted stress no doubt plays a large part in their personal life. Are they unhappy? Is their family unhappy? The client may be earning a 6-figure salary and may be financially comfortable, but does their financial status paint the whole picture? Evidently not.

In the above scenario, rather than blindly assuming that the client wants to increase their profits and take-home pay indefinitely, a great advisor will be able to pick up on the client’s stress level – whether that be through general chit chat, or more focused questioning built to detect what really matters to the client.

An obvious avenue where we could help to reduce the client’s stress levels would be to focus on reducing their workload – even at the expense of a portion of that 6-figure take-home pay package (at least for the short-term). Perhaps we can help the client to delegate some of the more intensive work that they do that, perhaps, they should not be doing.

We must empathise with our clients’ needs and identify the things that matter to each and every business owner and their family. There is little value in guiding clients to a place they don’t want to be. In fact, we need to be careful that we are not doing more harm than good.

Proactive accountants must ‘understand that each client is different and that we need to understand those needs of each client, including their goals’.

Shaz Nawaz of Entrust Property Tax Experts

Accountants need to ‘be able to decipher information & data from a business viewpoint’.

Marie Donaldson of Fresh Clarity

Why does it matter to your clients that you are proactive?

We asked our panel of accountants the above question. Do we really need to be proactive? After all, our raison d’etre is primarily preparing accounts and tax returns – a fairly transactional area with little scope for doing “more” – other than perhaps, doing it quicker.

The overwhelming response was that, it does matter to clients that we offer them a proactive service, with the following advantages being listed:

Being proactive…

- supports our clients’ financial and personal wellbeing

- gives our clients peace of mind that they are in safe hands

- builds trust and strengthens relationships with clients

‘We offer results, to do things better, to increase profits, to win better contracts, to grow the business, to give the owners back their time to go on holiday and enjoy themselves’.

Glenn Martin of Avery Martin Accountants

‘It is one of the main reasons that clients cite are important to them about their accountant. It encourages them to talk to us about their problems and challenges – resulting in us truly becoming their trusted advisor’.

Reza Hooda of Walji & Co

Clients ‘don’t want to find out what could have been, they want to know what they can do. They want to know that we’re interested in their business and helping them achieve success’.

Marie Donaldson of Fresh Clarity

‘Without being proactive we would not be offering the advice and guidance that can make a difference to a client’s financial wealth and mental health wellbeing’.

Jason Holden of Holden Associates

‘It means pre-empting their concerns and questions based on their business model, finances and business goals. For our clients, our proactivity gives them complete comfort and peace of mind that we have everything in hand and their best interests at heart, always’.

Nicola Sorrell of Effective Accounting

Why does it matter to you that you are proactive?

We also asked our panel of accountants if they could articulate exactly why it matters to them that they are proactive.

Of course, the above benefits received by our clients should be enough in themselves to persuade us that it matters that we offer a proactive service.

However, further points were made, as follows…

As an accountant, being proactive…

- helps us to make a positive difference

- enhances our professional reputation as a trusted advisor

- increases our firm’s profit

- makes work fun

It is the ultimate in customer service. You are solving problems before the customer even knows they have them. That makes working with us frictionless.

Simon Chaplin of GreenStones

‘It shows that we truly care, strengthens the relationships we have with our clients, and it means that we are genuinely adding value to our clients’.

Reza Hooda of Walji & Co

In practice, how do we become more proactive?

Whilst there are certain personality traits that we are born with that will assist us in our quest to become more proactive, there are many things that we can do and optimise now to maximise the level of proactivity within the service that we provide to clients.

In our next blog posts in this series, we will be looking at ways for accountants to put the results of our research into practice. How can we ensure that the 6 vital qualities of a proactive accountant, agreed upon by our panel of leading accountants, are intertwined into what we believe and what we do on a day-to-day basis?

A sincere thank you to the following proactive accountants that took part in our research…

Simon Chaplin – GreenStones

Marie Donaldson – Fresh Clarity

Caroline Harridence – Counting Clouds Cambridgeshire

Jason Holden – Holden Associates

Reza Hooda – Walji & Co

Glenn Martin – Avery Martin Accountants

Shaz Nawaz – Entrust Property Tax Experts

Nicola Sorrell – Effective Accounting

Founder & Chartered Accountant

PF Director – Intelligent web based advisory software for accountants.

Take a free trial today.