Measuring the unmeasurable

Last week I was reading a discussion in a closed Facebook group for accountants in the United Kingdom. The discussion started with an accountant relaying a question that she had received from a client that day. The client had asked the accountant to “justify or explain the value of management accounts to their business”. Presumably, the client was questioning the accountant’s fee for producing the same.

There was a hive of activity from accountants answering the question from their own personal viewpoint. Frustratingly (for accountants that like to put a figure on everything, if possible) nobody could put a specific financial figure on the value of management accounts. Of course, this was always going to be the case. The question was highly subjective in nature.

I commented that the “value of actually producing the management accounts is minimal. The value is only added when insights (which result in positive decisions being made) on the figures are made that otherwise wouldn’t have been made”.

This is an area that I am very interested in. As accountants, we generally have a great ability to communicate the value to the client in carrying out our recommended tax planning exercises, sales growth techniques, or cost-reduction processes. It is easy to put a monetary value on the provision of such advice. This makes it a great way of framing our comparatively lower fee in a good light. However, are we overlooking the overall more meaningful impact of our advice?

Measuring the meaningful

I strongly believe that the impact of our advice is not just financial. I believe that great accountants can and do provide much more value than can be measured on a financial cost-benefit graph. If we take a step backward from looking at the client’s business as a single entity and consider the needs and wants of the business owner(s) themselves too – then that is where we can add a deeper level of understanding and can – as a result – provide more meaningful advice.

I believe that the wellbeing (financial and otherwise) of the individual business owner themselves must be considered and measured in order to put any sort of value on the advice that we give to our clients. The difficulty is, of course, that sometimes improvement in the financial wellbeing of the business entity (through sales maximization strategies, for example) can have an extremely detrimental effect on the wellbeing of the individual behind the business.

For example, an adviser that successfully helps a client to hit an annual turnover target without a thought about the human consequence of that extra work is not looking at the whole picture. Although the individual client will, of course, be very happy that the business has achieved its financial goal, the process may have been out of their comfort zone which resulted in long working hours and associated stress for the business owner themselves. Which impact would you measure in this scenario? Just the increase in the sales figure? Or would you also build the non-financial impact into the picture? E.g. stress level, anxiety, work/life balance, happiness of the client, happiness of the client’s family?

Let’s go back to the original question, how do you put a value on the advice that you give?

Great advisers will build a model whereby they can monitor, on a regular basis, all of the above variables (or other relevant variables for each client). Each variable (financial and non-financial) will be measured, compared and forecasted. Correlations and assertions will be made regarding the relationship between the different variables and, through careful planning with the client, an action plan will be devised to work out the overall optimum solution to the client’s situation. Plan, do, measure, repeat.

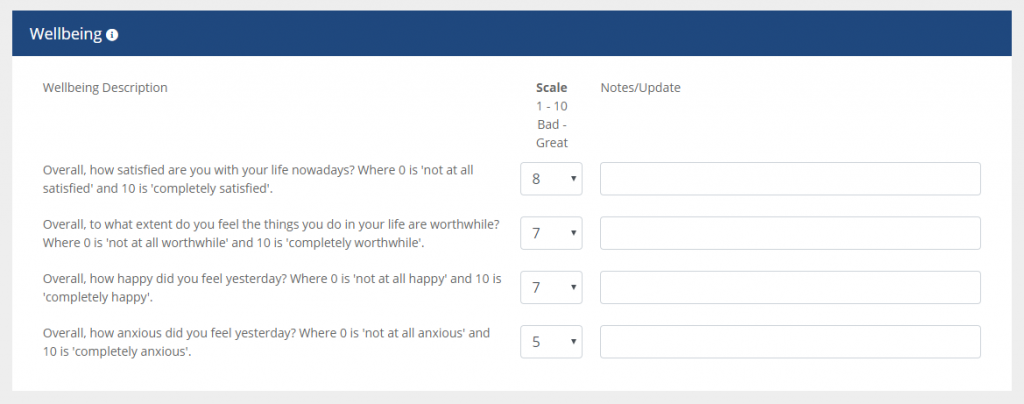

Our software solution, PF Director, has been built to do exactly that. As well as providing the accountant with the means to systematically measure the client’s individual and business financial progress against their goals, they can also record the client’s non-financial key performance indicators (again personal or business-centric) and compare them against their goals. Furthermore, we provide the accountant with the ability to track the individual client’s wellbeing. This is done by asking the client four questions regarding their current level of satisfaction, worthwhileness, happiness, and anxiety. These questions are the exact questions that are included in the periodic wellbeing survey sent out to UK residents by the Office of National Statistics (ONS). Often, the discussions that accompany the answering of these four questions are very revealing and result in additional related work if the accountant can assist (or a referral can be made to a 3rd party expert).

Of course, every individual will answer these questions differently – which gives their comparison against the national average limited value. However, by comparing the client’s current values against their previous values, insights can be gained which, in turn, result in better advice being given and better decisions being made.

I have worked with Steve Pipe in order to build an ‘impact’ tool directly into PF Director’s advisory process. What I love about Steve’s ‘Give and Get a Million’ initiative is that it ties in the financial impact of the accountant’s advice with the wellbeing of the business owner. It does this through an impact statement that displays the financial impact of the advice – but it also asks the following simple question to the client “What does this mean to you?”. It also goes a step further in allowing the accountant to tie in the advice that they give with making a bigger impact through charitable giving.

Conclusion

It is extremely easy to measure the impact of financial advice that we give to clients where there are relevant and objective numbers involved (e.g. tax savings made, profit growth, sales growth, etc) – although I would argue that many accountants still don’t communicate this value effectively to clients. Making such measurements, in my opinion, only paints half of the picture. Although it can be more difficult to do, I believe that we must do more to measure many other variables surrounding the wellbeing of our clients. This then allows us to provide much more tailored and meaningful advice to clients. Only then can we say that we truly have our client’s best interests at heart.

Founder & Chartered Accountant

PF Director – Intelligent web based advisory software for accountants.

Take a free trial today.